Carbon pricing is among the most prominent policy instruments being used or considered by governments to reduce emissions today. Proponents argue that carbon pricing may allow us to reach internationally accepted temperature targets at minimal cost (Borissov et al. 2019, Gollier and Tirole 2015, Rausch et al. 2011).

However, most studies suggest that carbon taxes will negatively affect output and could be regressive (Grainger and Kolstad 2010, Mathur and Morris 2014, van der Ploeg et al. 2021), though some emerging empirical studies challenge this (e.g. Klenert and Hepburn 2018, Metcalf and Stock 2020, Shapiro 2021). Mitigating factors that can reduce output losses or reduce rising inequality have received substantial attention in the literature, particularly the mechanism for redistributing carbon-tax revenue.

What has received less attention is the mitigating role of policies that promote education quality. Better quality education has the potential to (1) improve the supply skills needed to enable green technological innovation in response to carbon pricing, leading to lower output losses and higher reductions in carbon emissions; and (2) reduce inequality resulting from carbon pricing by ensuring that ‘green’ skill acquisition is accessible to all.

Emerging research suggests that green technological change relies on human capital. For example, the role of education and skilled labour for the transition to green growth in the report of the Commission on Carbon Pricing (Stiglitz et al. 2017) explains that production using clean technologies is human capital-intensive so education decisions become closely interlinked with the energy transition (Yao et al. 2020). At the same time, shortages of skilled labour may constrain the decarbonisation process of an economy (OECD 2017). Human capital has also been linked to firms better adapting to climate change and environmental regulations (Lan and Munro 2013, Pargal and Wheeler 1996).

Carbon pricing – through its impact on human-capital accumulation – may not only be the cornerstone of climate policy but may also act as a development policy, fostering technology switches and education of the labour force. However, if green technological change relies on higher-skilled workers and, as a result, is skill-biased, then the increased demand for higher-skilled labour resulting from carbon taxes may further widen the earnings gap between high- and low-skilled workers.

In a recent paper (Macdonald and Patrinos 2021), we consider how education quality interacts with carbon pricing’s effect on emissions, output, and wage inequality. Education quality – as a determinant of the elasticity of skill supply in the economy – may act as a mitigating factor both for the impact of carbon pricing on emissions reduction and on economic outcomes, including wage inequality and output.

This argument is parallel to skills and automation: if automation complements higher-skilled workers’ productivity, then the elasticity of skill supply – for example, through the quality of education – enhances the economic benefits of automation and mitigates its costs (Bentaouet Kattan et al. 2020).

We test the hypothesis that cognitive skills, as an indicator of overall human capital, are associated with a lower reliance on emissions in aggregate production technology and estimate the subsequent mitigating effect of education quality on carbon pricing’s effectiveness and economic consequences, including wage inequality.

Using data on workers’ cognitive skills and their industry’s emissions for 21 European countries, we find that cognitive skills are associated with lower emissions per output and faster reductions in emissions per output across time. All three measures of cognitive skills in the OECD dataset – literacy, numeracy, and problem-solving – were associated with reduced emissions per unit of output (see Figure 1). We found this association to be true within countries, controlling for level of education, and primarily associated with the cognitive skills of professional and managerial occupations, which would be most involved in innovation and adaption.

Figure 1 Association between one-standard-deviation-higher cognitve skills of employees and average annual growth rates in industries’ CO2 emissions per unit of value-added in percentage point terms

Notes: Estimates using OECD PIAAC data 2012 merged with EU Emissions Accounts by Industry for 2012 to 2019. Observations are 67,877 workers in 21 countries for numeracy and literacy skills; 44,446 workers and 17 countries for problem-solving skills. Associations estimated using linear regression models controlling for education level, sex, age and fixed effects for each country.

Source: Macdonald and Partinos 2021.

Variation in the reduction of reliance on emissions across industries and within countries is likely the result of technological change, either through innovation or adaption. The association between cognitive skills and reduction in reliance on emissions by industries is consistent with skill-level as an enabler of innovation or technology adoption. This is further supported by the finding that the association between skills and reduced reliance on emissions are predominantly among managerial and professional occupations, which are most involved in innovation and driving technological change.

These findings are also consistent with green technology – which enables production with fewer emissions – being skill-biased: workers with a higher level of literacy skills contribute more to reducing the production function’s reliance on emissions relative to capital.

To understand how education quality can interact with carbon pricing, we estimate a general equilibrium macroeconomic model for 15 European countries and predict the marginal effects of an increase in the price of carbon on output, emissions, and wage inequality – defined as differences in wages that children from wealthy and poorer households earn when they reach adulthood – to capture inequality of opportunity. Using the OECD PISA data for each country, we estimate the overall ability of households to acquire cognitive skills for their children as well as differences in ability between richer and poorer households to acquire cognitive skills. Higher-quality education systems are, in our model, able to provide more cognitive skills for a given level of investment in education and can do so more equitably.

Our estimated baseline models predict that a carbon tax reduces emissions but also negatively affects output, consistent with standard macro models of carbon pricing. A carbon tax also increases wage inequality which, in our model, is a result of green technological change being skill-biased and the inequality in skill acquisition between richer and poorer households measured in PISA.

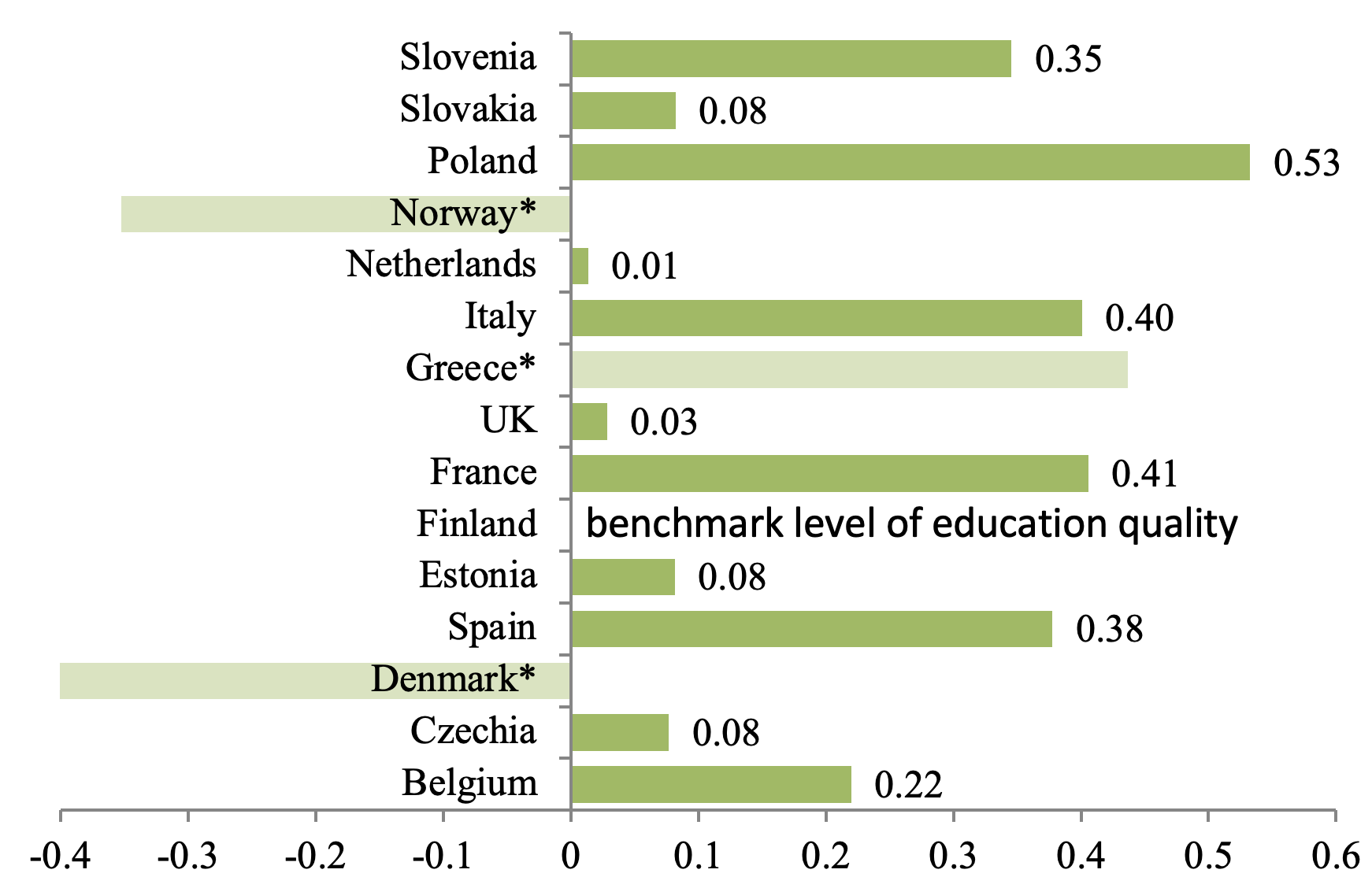

We then study how the marginal effects of a carbon tax for each country compare between the baseline education quality regime as measured in PISA and each of two counterfactual education quality regimes. In the first counterfactual, we compared how the marginal effects of a carbon tax would change if each country had the same level of education quality as Finland – the country with the highest level of education in our estimates. In the second counterfactual, we compared how the marginal effects of a carbon tax would have changed because of changes in the quality of education measured in PISA across time (see Figure 2).

Figure 2 Projected annual percent of GDP saved according to countries’ current education quality (compared to Finland’s, as measured in PISA) if a carbon tax were used to reduce emissions by 55%

Note: Estimates not statistically significant for Denmark, Greece, and Norway. Source: Linearised projection based on marginal effects presented in Macdonald and Patrinos 2021.

For both simulations, we found that improvements in education quality (1) strengthened the marginal effect of a carbon tax on reducing emissions, (2) reduced the negative effect on output, and (3) reduced the positive effect on wage inequality. The magnitude of effect varies by country depending, in the first scenario, on the difference in education quality between Finland and the country in question and, in the second scenario, by how much education quality has improved (or declined) across time.

By projecting the changes in the marginal effects, we can offer a sense perspective of the impact. For example, in the early 2000s, Poland implemented a significant education reform that improved its education quality substantially. The reform, which raised the age of streaming into vocational programmes among other policy changes, had few recurrent cost implications but a large impact on cognitive skills. In our estimated model, if Poland increased its carbon tax to achieve the EU’s carbon reduction targets, the loss in GDP would be a quarter of a per cent less thanks to the increase in education quality from the reform.

Our findings that cognitive skills are associated with industries that are more efficient in terms of emissions per output – and, subsequently, that education quality plays a mitigating role – is consistent with greener technology requiring a higher level of skills than existing technology. These findings also echo the literature showing that firm-level human capital improves environmental compliance and practices, and higher education’s association with reduced emissions at the macro level. Green technology is skill-biased. However, our model does not explain why this would be the case, and the topic deserves further research.

Our model could be extended in several ways in future research. First, labour mobility could be added to understand how the variation in education quality across the EU may affect the impact of carbon pricing. For example, countries with lower-quality education systems may have higher elasticity in skill supply by attracting foreign-trained labour; however, the presence of low-quality education systems within the EU may lower the elasticity of skill supply for the EU as a whole.

A second extension of the model would be to include other mitigating factors, such as progressive or otherwise targeted redistribution of a carbon tax, and compare the strength of the mitigating effect with increased education quality.

Finally, a third extension is to transform the framework into a growth model and examine steady-state growth outcomes. This would allow us to better understand how the elasticity of skill supply affects carbon pricing’s impact on annual changes in carbon emissions and other macroeconomic outcomes including output.

Carbon pricing to reduce emissions that is accompanied by improvements in education quality will result in better environmental and economic outcomes. In this context, investing in education quality is not to change the values or behaviours of consumers but rather to enable technological change that can reduce emissions. Human-capital investment should improve cognitive skills and enable technological change to mitigate the costs and enhance the benefits of increased carbon pricing.

References

Borissov, K, A Brausmann and L Bretschger (2019), “Carbon pricing, technology transition, and skill-based development”, European Economic Review 118: 252–69.

Bentaouet Kattan, R, K Macdonald and H Patrinos (2020), “The role of education in mitigating automation’s effect on wage inequality”, Labour 35: 79–104.

Gollier, C, and J Tirole (2015), “Negotiating effective institutions against climate change”, Economics of Energy and Environmental Policy 4(2): 5–28.

Grainger, C A, and C D Kolstad (2010), “Who pays a price on carbon?”, Environmental and Resource Economics 46(3): 359–76.

Klenert, D, and C Hepburn (2018), “Making carbon pricing work for citizens”, VoxEU.org, 31 July.

Lan, J, and A Munro (2013), “Environmental compliance and human capital: evidence from Chinese industrial firms”, Resource and Energy Economics 35(4): 534–57.

Macdonald, K, and H Patrinos (2021), “Education quality, green technology, and the economic impact of carbon pricing”, Policy Research Working Paper No. 9808, World Bank.

Mathur, A, and A C Morris (2014), “Distributional effects of a carbon tax in broader US fiscal reform”, Energy Policy 66: 326–34.

Metcalf, G E, and J H Stock (2020), “Measuring the macroeconomic impact of carbon taxes”, AEA Papers and Proceedings 110: 101–106.

OECD (2017), Boosting skills for greener jobs in Flanders, OECD.

Pargal, S, and D Wheeler (1996), “Informal regulation of industrial pollution in developing countries: Evidence from Indonesia”, Journal of Political Economy 104(6): 1314–27.

Rausch, S, G Metcalf and J Reilly (2011), “Distributional impacts of carbon pricing: A general equilibrium approach with micro data for households”, VoxEU.org, 10 June.

Shapiro, J (2021), “Pollution trends and US environmental policy: Lessons from the last half century”, VoxEU.org, 2 December.

Stiglitz, J E, N Stern, M Duan, O Edenhofer, G Giraud, G M Heal, E L La Rovere, A Morris, E Moyer, M Pangestu and P R Shukla (2017), Report of the High-Level Commission on Carbon Prices, World Bank.

van der Ploeg, R, A Rezai and M Tovar (2021), “Carbon tax recycling and popular support in Germany,” VoxEU.org, 2 November.

Yao, Y, K Ivanovski, J Inekwe and R Smyth (2020), “Human capital and CO2 emissions in the long run”, Energy Economics 91.