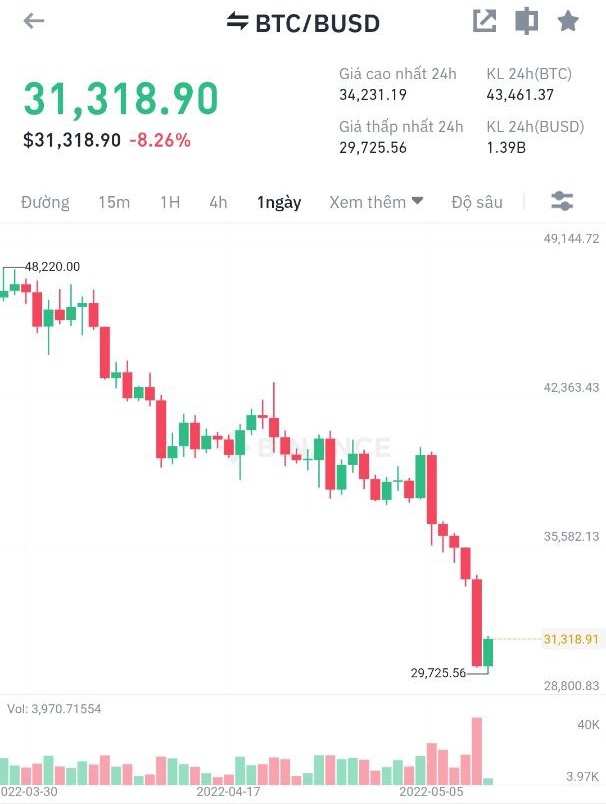

Bitcoin price last night suddenly dropped 11% to close to $ 30,000, half of the peak of November 2021, leaving many investors confused and not understanding what had just happened.

One of the most talked about reasons for this drop is that the Fed’s rate hikes coupled with weak economic conditions around the world have driven money out of assets like cryptocurrencies. and stocks.

But some sources said that the sharp drop last night was also caused by the “discharge” of one of the biggest sharks holding Bitcoin – Terraform Labs (TFL) the organization behind the stablecoin based on the UST algorithm (TerraUSD), and both LUNA and Luna Foundation Guard (LFG) coins.

Last night, Terraform Labs sold off all of its Bitcoin holdings – about 42,530 Bitcoins – equivalent to $1.3 billion. Once expected to revive Bitcoin with a plan to buy about 10 billion USD to stabilize the stablecoin UST, now Terraform Labs itself has become a “sinner” when selling a large volume of Bitcoin, pushing up the price. of the cryptocurrency fell to its lowest level in recent months.

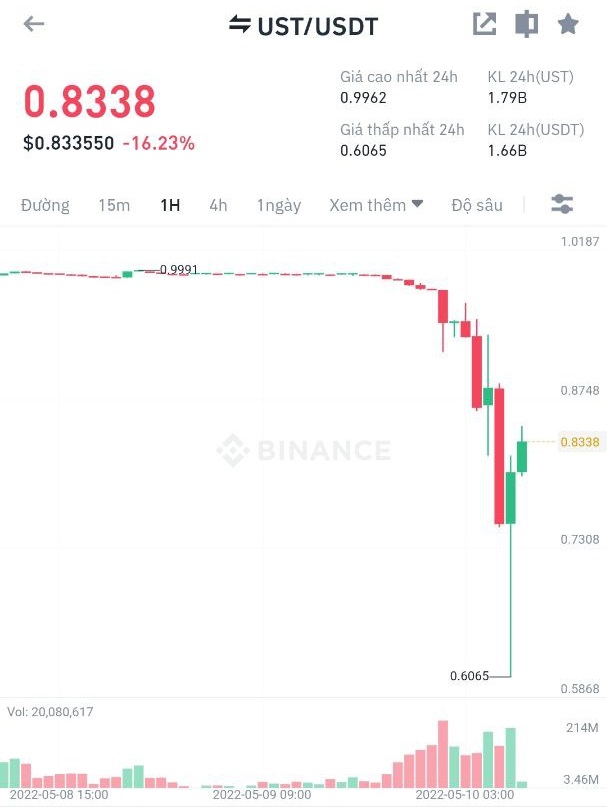

In fact, the UST also lost its ability to peddle 1:1 with the USD for the second time in the past 3 days as the price dropped 5.3% to 95 cents last night. In order to maintain the price of 1 USD, ensuring a 1:1 ratio when pegged to USD, LFG may be forced to sell its entire LUNA and Bitcoin reserves.

Recently, a tweet by Do Kwon, founder of Terraform Labs, said that they are “deploying more capital” to support their stablecoin, but did not give details. In addition, Kwon also tweeted: “LFG not trying to exit all of its Bitcoin positions“and said”The goal is to have this capital in the hands of a professional market maker” so they need to boost UST liquidity.

However, this task is becoming more and more difficult for Terraform Labs as the value of UST is still on the decline. From the price of 95 cents, a few hours ago UST suddenly dropped to only 0.8 USD (sometimes even fell to 0.6 USD). However, compared to the 1:1 ratio when pegged to the USD, this price is too low for a stablecoin.

The drop in the price of UST has a more dangerous effect than many people think. As the central currency for the ecosystem built by Terraform Labs over the years, the decline of UST could have a negative impact beyond its scope.

Simon Furlong, co-founder and COO of Geode Finance, told TechCrunch: “There is more than $18 billion (US market capitalization) of UST-related liquidity in the vast DeFi ecosystem – where UST is being used as collateral and in various reserves – which is possible. wiped out and caused a wave of crashes across the DeFi market.”

After two years of euphoric growth, winter in the crypto market is coming and its negative effects may be just beginning.

Check out TechCrunch