Matt Damon – famous American actor, film producer and screenwriter – walks through a white corridor. As he walked, he talked about what makes a person brave. Everest climbers are brave. The Wright brothers, the world’s first two pilots, were very brave men. So are the astronauts. Adventurers and entrepreneurs are also brave because they know to “seize the moment and commit”.

“Luck,The actor nodded and said, “support the brave.”

A scene from Matt Damon’s cryptocurrency promotional video.

And that’s what was in a video by Damon promoting the services of Crypto.com, a Singapore-based cryptocurrency exchange that recently spent $700 million for the naming rights to the platform. Los Angeles’s largest giant general sports area, where top basketball matches are regularly held.

Damon is not the only celebrity promoting in the crypto space. Tom Brady, the famous American football midfielder, is a spokesman for the crypto exchange FTX. TikTok star Charli D’Amelio is promoting Gemini exchange. As for Kim Kardashian, recently “shill” a little-known cryptocurrency called EthereumMax to her 276 million Instagram followers in May. In Vietnam, a few streamers have also been practicing recently. shill little-known, and seemingly successful, GameFi projects.

Cryptocurrency ads are now everywhere. Facebook recently reversed its ban on cryptocurrency advertising content. Both Crypto.com and FTX even ran ads during the broadcast of this year’s famous Super Bowl event, where each 30-second ad was worth up to $6.5 million. As for Damon’s TV ad, which ran for several months and cost about $38 million.

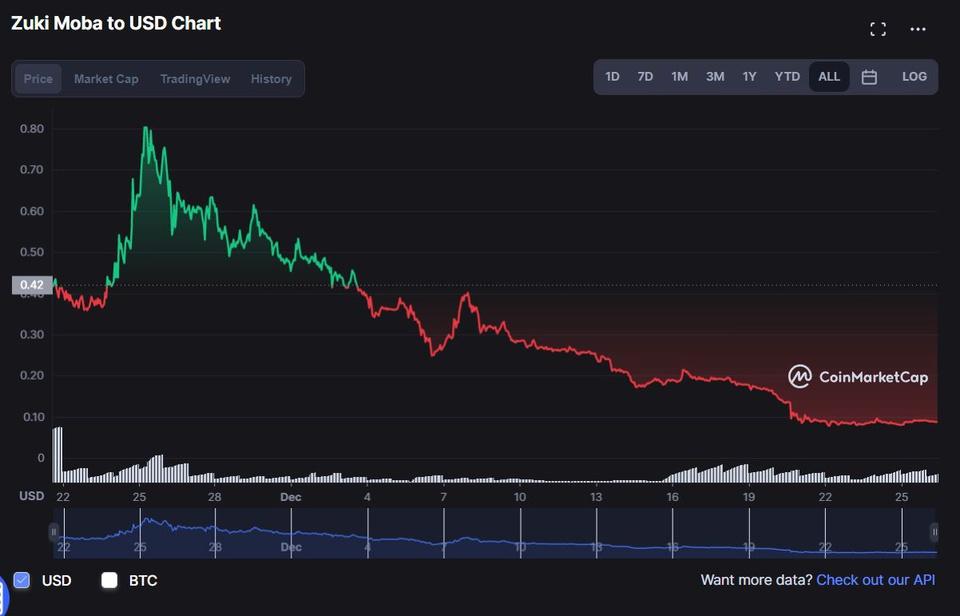

And its content is clearly somewhat correct. You need to be brave to invest in cryptocurrency, as it is one of the most volatile and unregulated assets available to new and retail investors.

You have to be really brave when investing in cryptocurrencies like this, following in the footsteps of new KOLs with only a few months of market experience.

Is Cryptocurrency a Smart Investment?

Crypto.com’s ad advises viewers to be brave. And if bravery requires investing in assets with little or no transparency, crypto investments are truly a test of courage.

In general, securities laws in many countries require companies to disclose important information about stocks and other financial products including who is responsible, financial results and forecasts of what is to come. . Investors have legal recourse if they have been misled or defrauded. But none of the same regulations apply to cryptocurrencies.

Mostly, many crypto platforms just have a “white paper” stating their purpose. As Bitcoin is used in peer-to-peer financial transactions and Ethereum is built to host decentralized software. But the coins associated with these blockchains are not, not even at all.

If bravery requires investing in assets with little or no transparency, crypto investments are truly a test of courage.

However, cryptocurrencies have become extremely popular among speculators, not just retail investors. The cryptocurrency market has been flooded with institutional investors in recent years, including hedge funds, pension funds, and endowers. Banks and venture capitalists are also getting into this area.

Since the beginning of March 2020, the bitcoin price has nearly quadrupled to $43,118, while the price of Ethereum has increased tenfold. That brings in loads of returns: $1,000 invested in bitcoin in March 2020, would be worth around $5,000 today. By comparison, a similar, low-risk investment, like the Fidelity 500 Index Fund, would only raise your money to $1,577 in that time.

Risks of Cryptocurrencies

“Cryptocurrencies are orders of magnitude greater risk than anything in the stock market,” Eshwar Venugopal, a professor of finance at the University of Central Florida. And that is mainly due to the lack of financial transparency and legal accountability that comes with it when compared to a regulated stock market.

He likens investing in crypto to being an angel investor in an early stage startup and you have to know that your investment can go to zero. For investors electronic money, “risks are due to lack of information, misinformation and speculation”, he said.

A tweet by Elon Musk is extremely important to the Dogecoin meme.

Professor Venugopal said the riskiest crypto products have no white papers or no real business purpose. Memes like Dogecoin and Shiba Inu have become the 12th and 13th most valuable cryptocurrencies by market capitalization. And in no small part is due to the tweet of a famous person, Tesla CEO Elon Mus. A tweet from Musk is extremely important, as the price of this crypto-asset is often not tied to financial performance.

“Cryptocurrencies are orders of magnitude greater risk than anything in the stock market” – Eshwar Venugopal, professor of finance

A recent study from Yale and the University of Rochester has found that cryptocurrency prices are primarily driven by two factors: trading momentum and investor attention. In other words, it’s exaggeration. The prices of the cryptocurrencies in the study — Bitcoin, Ether, and Ripple — are not correlated with normal transit, as they are in traditional asset classes such as stocks, currencies, and commodities.

How to Add Cryptocurrencies to Your Portfolio

So should a retail investor invest in cryptocurrencies?

Although institutional and network investing can reduce risk, retail investors should still be very cautious. Even professional financial planners try to advise clients of the risks that come with investing in cryptocurrencies, but many recommend putting more than 5% of your portfolio in crypto. death.

Caitlin Cook, head of community for Onramp Invest, a software company that provides information and advice to the crypto market, said planners and investors need to understand how money markets work. how electronics fluctuate and budget accordingly if they want to invest.

“If you see a 30% drop in crypto value in a day, can you accept that?”, Cook asked the question. “Personally, I firmly believe that you should not weigh these investments more than you can accept they are likely to go to zero, no matter how optimistic you are about the sector.”

Refer QZ

.